The Intelligence Revolution: Why “Asking” is Overtaking “Doing” in AI

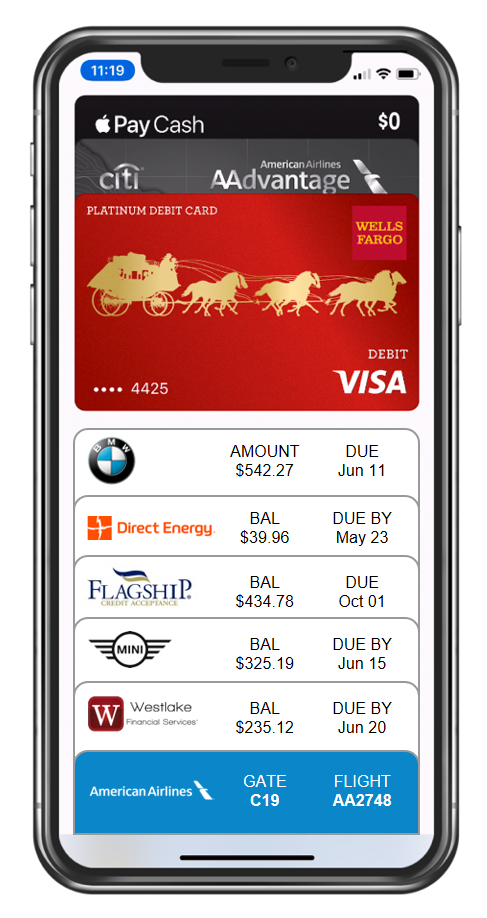

The Intelligence Revolution: Why “Asking” is Overtaking “Doing” in AI A significant study on AI usage recently published has just validated something we’ve been saying at amotivv for a while now: Yes, the future of artificial intelligence is about task automation and task optimization — BUT what is making powerful today is about relationship intelligence…