11.10.21, London PPS, an Edenred company, today announces its partnership with UK-based Sprive, the first of its kind mortgage overpayment app designed to help homeowners become mortgage-free faster and save interest.

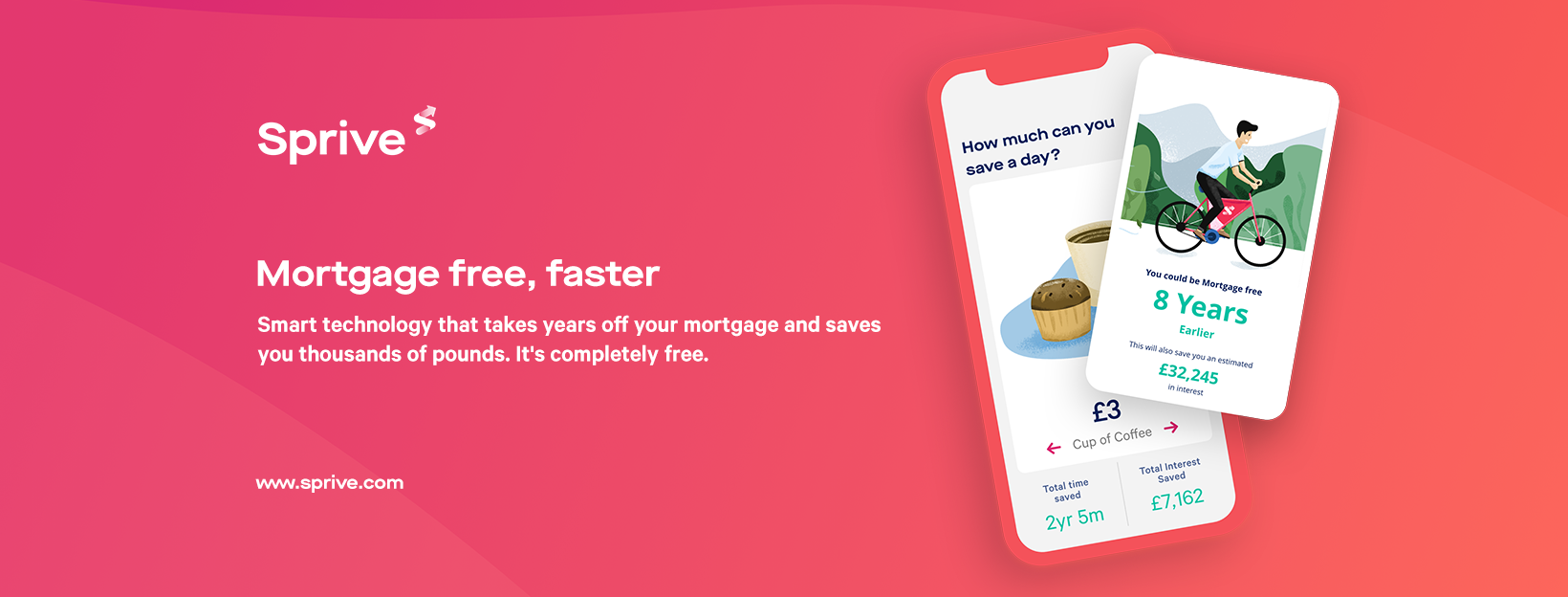

On average Sprive’s existing customers are on track to pay off their mortgages eight years earlier and save £32,000 in interest. PPS provides Sprive with its payments technology platform, payments licensing, and processing services including e-Wallet provision, access to the Instant Faster Payments Service, regulatory adherence, and anti-fraud services.

With the help of PPS, Sprive’s iOS and Android app links directly to a customer’s bank account to analyze spending information and gain automatic access to mortgage information. Sprive’s AI then determines how much money to set aside for optional mortgage overpayments according to a customer’s spending habits.

The app will suggest certain spend limits that will not impact a customer’s lifestyle, with the option to move money from the user’s account to a Sprive-controlled e-Wallet made possible thanks to PPS technology. Once a customer’s money is saved, they are able to choose whether to partially or fully pay back the amount before Sprive pays it into the mortgage holding bank on the user’s behalf.

Ray Brash, Chief Executive Officer at PPS, said: “As a leading driver of innovation in fintech and paytech across Europe we are committed to working with both established players and growing start-up brands cross-vertical, such as Sprive. Utilizing our platform, access to networks, and expert knowledge within the PPS team, together we’ve built a truly unique payments infrastructure that will significantly support the growth of Sprive’s user base.

“We know Sprive will make a significant difference to how the mortgage market operates by putting more power into consumers’ hands, enabled by our white-labeled technology.”

Jinesh Vohra, Chief Executive Officer at Sprive added: “We were aware that PPS had excellent technology, compliance, and commercial credentials and a great existing customer base, but what impressed us most was how deeply and quickly they understood our vision. We know that by working with PPS’ platform and a team of knowledgeable experts, we will be fully supported on our growth journey. Together, we will help UK mortgage holders reduce debt, pay off their mortgage earlier and save tens of thousands of pounds”.

To find out more about PPS, visit: https://www.pps.edenred.com/

To find out more about Sprive, visit: https://sprive.com/