Technology has several goals for retail banks, including the migration of transactions and sales to digital channels, 24/7 customer access for every interaction, a personalized approach to sales, and a unified, omnichannel user experience—meaning that customers have a seamless experience whether they are online, on an app, or in the branch.

Micro Branch is a robust banking model with a digital platform as its base. Micro-Branches are a type of physical bank branch that requires a much smaller footprint than the typical branch by merging the Digital and Physical banking experiences.

Customers should be able to walk into a micro branch at any time of day or night and get anything they need, from new products like loans or credit cards to service. And the user experience should be consistent across devices. The micro branch banking model connects the bank with remote areas, local market, corporate offices thus maximizing the number of customers

Benefits to Financial Institutions

- Easy Deployment of Branch:

- Cost effective and Better Reach:

- Lower transaction cost:

- Grow network at premium places of High Foot Traffic:

The following case study depicts a customer’s hassle-free banking experience when he walks into a microbranch.

Gary, a 50-year-old Professor, walks into a micro branch of the bank located in the University campus. He is pleased with the greetings at the door with a standard automated welcome message that is displayed on a digital signage. He uses the Cash Deposit Teller Machine and delighted that doesn’t require to fill any deposit slip to deposit cash into his wife’s account. He follows the instructions/steps displayed on the Cash Deposit Teller Machine The transaction is completed in less than a minute. He is content with the facilities in the micro branch.

Next, he walks to the Self-Service Kiosk. The Kiosk greets Gary with a recorded welcome message. Gary raises a new debit card request by selecting the New Debit Card request option and enters the account details. The Kiosk authenticates him by asking One-Time-Password (OTP) sent to his registered mobile number. He completes the authentication by entering the OTP. The Kiosk processes the debit card request and confirms the transaction is complete. He receives the confirmation message with timeline of delivery on his mobile. Gary is happy with the overall service and hassle-free experience.

Gary looks around at the digital signage that displays various investment schemes and offers. He is interested in one of the investments offers and wants to know more about the investment scheme. He walks to the Digital Avatar Kiosk with voice recognition features, where the kiosk accepted his queries via natural speech. The Avatar responded to his query by displaying the list of investment schemes and benefits that the bank has to offer.

Gary is impressed with the interaction but still skeptical so is directed to Video Chat support by the Digital Avatar Kiosk. He asked more questions to the assistant through Video Chat support. At the same time, the camera at the Kiosk captures and analyzes Gary’s mood and non-ID information. After Gary has decided his investment option, the Digital Avatar Kiosk helps him with instantaneous identity verification. Gary is happy with the hassle-free experience and completes the transaction. He also takes up the automated quick survey, and shares information about his banking experience!

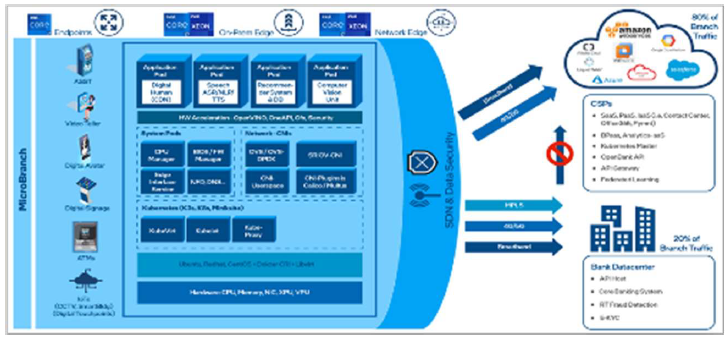

Micro Branch Architecture

Key Intel® Technologies in a Micro Branch

Intel® works with a broad set of ecosystem partners to provide hardware and software solutions. Intel® processor-based platforms are widely adopted in the bank branches, to run a host of solution such as ATMs, VTM s, Smart Building Management, Digital Security & Surveillance etc. To promote interoperability, Intel® has collaborated with the ecosystem on several platform specifications, including:

Summary

Going forward, business for banking institutions is about having a compact space, equipped with emerging technologies, and provide a unified banking experience to the customers. The model is not only cost effective, but it also provides the flexibility of modifying as per the customer base in a particular area.