The Rise of Institutional Digital Asset Custody and Tokenization

By Ganeshram Ramamurthy

As the crypto winter of 2022 thaws and we approach 2024, the prices of Bitcoin and other cryptocurrencies are climbing once again, sparking renewed public interest. This upward trend presents a golden opportunity for banks and other financial institutions to incorporate digital asset custody and tokenization into their services through blockchain solutions.

While the prime moment for initial adoption may have slipped by, the urgency to act remains high. Digital assets, extending beyond just cryptocurrencies, have attracted the attention of both retail investors and institutional players. Tokenized illiquid assets alone, a subset of digital assets, are expected to reach $16 trillion by 2030 (Boston Consulting Group).

Read on to learn about digital assets and tokenization, the key benefits for investors, why institutional adoption of digital assets is growing, and why financial institutions need to start exploring this new asset class.

What are digital assets and tokens?

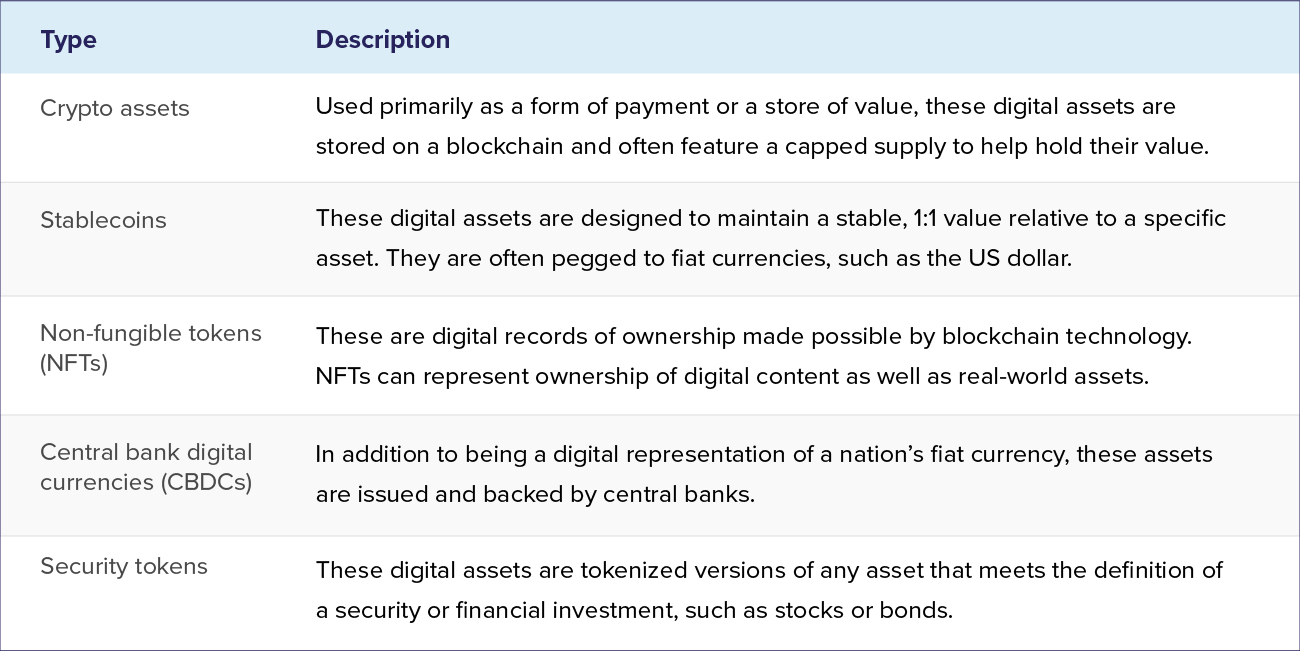

When you think of a digital asset, you may picture cryptocurrencies like Bitcoin and Ethereum, or NFTs like those of Bored Ape Yacht Club. In reality, digital assets encompass much more. They are an emerging asset class that includes NFTs, crypto assets like digital currencies and stablecoins, and even central bank digital currencies (CBDCs). Real-world assets such as real estate, art, and precious metals can even become digital assets through the process of tokenization.

Tokenization simply means subdividing ownership of an asset, physical or digital, through digital tokens. These tokens can be traded and stored on a blockchain, and smart contracts help manage the fractionalized ownership rights. Tokenized versions of traditional financial products like equities, bonds, derivatives, and ETFs are also included in this new asset class.

Types of Digital Assets

What are the benefits of tokenization and digital assets?

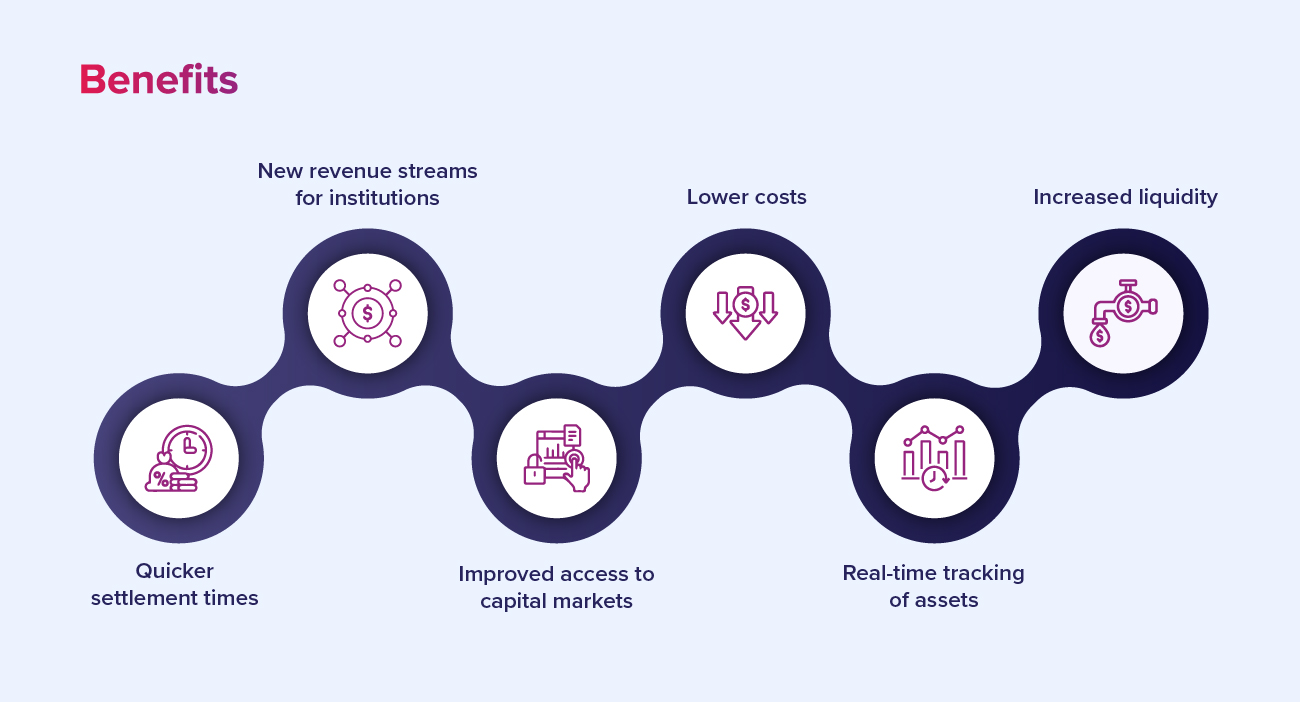

There are many features and benefits of tokenization and digital assets. One benefit institutions can take advantage of is getting the most out of illiquid assets by offering them to a new segment of investors. Just as the introduction of fractional shares was a boon to retail investors (and in turn, the financial institutions), fractional ownership of these illiquid assets could mean that investors who could not afford to buy the assets outright can now purchase fractions of assets.

Tokenization also enables the removal of intermediaries from the settlement process, making the movement of securities easier. Thanks to smart contracts, these inefficiencies can be wiped away by providing real-time visibility into the movement of these securities, streamlining the processes through automation — and, as a result, reducing costs.

Institutional adoption of digital assets is growing

With 82% of investors expecting their financial advisors to give them advice about Bitcoin (NYDIG), it’s no wonder financial institutions are getting in on the action. In fact, $130 billion in digital assets are traded by institutions every quarter on Coinbase alone (Coinbase).

To support the growing demand from clients, a host of financial institutions, including BlackRock, JP Morgan, Goldman Sachs, and Citigroup, are adopting blockchain technology to facilitate the movement of digital assets.

For example, Fidelity launched a platform called Fidelity Digital Asset Services in 2018 to serve the varying needs of institutional investors when it comes to digital assets.

BNY Mellon, too, has entered the ring with the release of its Digital Asset Custody platform in 2022 to support client demand. It’s the industry’s first multi-asset platform that bridges digital and traditional asset custody.

JP Morgan’s Onyx Digital Assets platform, released in 2020, has processed almost $900 billion of digital assets (JP Morgan).

Regulations will increase institutional adoption of digital assets

In addition to investor demands and the benefits of tokenizing assets, there are many factors that could lead to increased adoption of digital assets in the future. A major factor is, of course, regulation. With digital assets still in their infancy, there hadn’t been regulations put in place until relatively recently. That means that there was no clarity for financial institutions — they didn’t know what they could or couldn’t do.

Starting in 2019 with Liechtenstein’s Token and Trusted Technology Service Provider Act, though, there have been great strides on the regulation front regarding digital assets, including:

● The Markets in Crypto Assets proposal (MiCA) will provide a regulatory framework around digital assets in the EU starting in 2024.

● Lummis-Gillibrand Responsible Financial Innovation Act was reintroduced in July 2023 to create a comprehensive regulatory framework for crypto assets.

● The Future Finance Act, launched by Germany in 2023, aims to modernize corporate finance by permitting companies to issue shares using blockchain technology.

● The Financial Innovation and Technology for the 21st Century (FIT21) Act, a bill establishing a regulatory framework for digital assets, advanced to the House floor.

● The U.S. Treasury and IRS released proposed regulations in 2023 that would impose new information reporting requirements for brokers that facilitate certain transactions involving digital assets.

As for the Security vs Commodity debate, the classification of cryptocurrencies is far from decided and is likely to vary depending on the specific cryptocurrency.

Why financial institutions need to start exploring digital assets now

1. Competition from exchanges is growing. As cryptocurrency exchanges vie for market share, platforms like Coinbase have the financial resources to quickly develop and implement successful business models. As traditional assets continue to be digitized, these platforms will likely attract both institutional and retail investors by offering a wide range of services and assets, including digital stocks and tokenized real estate.

~95% of crypto wealth is bypassing traditional wealth management channels (Boston Consulting Group).

As a result, legacy financial service providers may need to adapt to the growing world of digital assets in order to remain competitive.

2. Digital asset custody services will increase investor confidence. Similar to the custodianship of traditional financial assets, digital asset custody involves securely storing assets. Safety of assets has always been a concern for institutional investors. The unique characteristics of digital assets, however, make custody of them especially crucial. With news like the FTX scandal leaving a bad taste in many people’s mouths, it’s important that traditional financial service providers step up to offer digital asset custody services to increase investor confidence.

Conclusion

As a new asset class that leverages blockchain technology, digital assets offer investors the opportunity to diversify their portfolios while reaping benefits such as quicker settlement times and improved access to capital markets. And as the infrastructure for digital assets improves and regulatory frameworks become more established, institutional investors will become more

comfortable with investing in this new asset class.

Due to client demand, the widespread potential, and the benefits of digital assets, financial institutions and custodians are beginning to embrace digital assets as a part of their asset offerings. Factors such as platform updates, evolving technology, retail and institutional interest, and governmental acceptance will drive further user adoption. In the coming years, it’s likely that digital assets will become a mainstream form of investment.

For a more visually engaging and shareable overview of this information, feel free to explore our accompanying infographic:

https://blockchain.relevantz.com/infographic-rise-of-digital-assets-tokenization/.

What Relevantz Can Do for You

Regardless of where you are in your digital asset custody and tokenization journey, Relevantz can help you accelerate your initiatives with our specialized tokenization engineering services. If you would like to learn more about our engineering services and how we have helped some of the largest financial services firms embrace tokenization using the latest in blockchain technologies,

please visit: blockchain.relevantz.com/.

Ganeshram Ramamurthy is a Technical Architect, Blockchain Enthusiast, and Smart Contract Developer at Relevantz.