How Alacriti Is Helping Financial Institutions Win with Instant Payments

by Tedd Huff

There are a lot of opinions about what’s next in payments. Most aren’t grounded in what financial institutions are actually doing. Here’s what actually matters: banks and credit unions are expected to do more, faster; Customers want access on demand; Regulators expect precision; Executives want better outcomes without new complexity. Alacriti has delivered tools that empower institutions to step up without getting stuck. Let’s walk through what that looks like today.

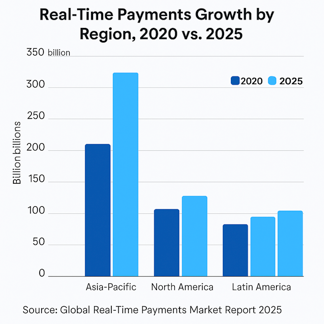

A Shifted Market

People expect their money to move fast. That includes payroll, transfers, refunds, and everything in between. The global market for real-time payments is on track to hit $49 billion this year, driven by both consumer expectations and business demand. Financial institutions that don’t meet that demand risk losing business to more agile competitors. What’s shifting isn’t the technology; it’s the tolerance for delay, and the patience for excuses is wearing thin. This is no longer optional; it’s table stakes.

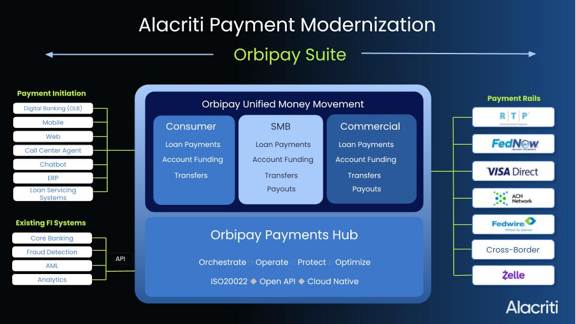

Simplifying the Payments Infrastructure

Alacriti recently upgraded its Orbipay Payments Hub with support for next-gen ACH. It now automates exceptions, connects directly to the Fed, and fits into existing systems without forcing a rip-and-replace. Same goes for their FedNow Service and RTP network readiness; they’re certified on both rails. More importantly, their bank and credit union customers are already sending and receiving money on them. The platform also supports customizable workflows, real-time monitoring, and secureAPI connections, so institutions don’t need to choose between speed and stability. It’s a practical path to modern payments without adding unnecessary complexity.

Real Results

A few examples of how this has become a reality, Veridian Credit Union and Ascend Federal Credit Union are live on the FedNow Service and RTP network. Royal Credit Union processed $9.2 million in instant deposits in the first quarter alone. Ascend FCU enabled 24/7 payment receipt across both networks.

These aren’t pilots or trials. They’re live systems built to scale.

What’s Next?

It’s not just about speed. Banks and credit unions are asking vendors for more than just faster payments. They want tools that cut down on manual work, connect easily with fraud and compliance systems, and bring all payment types—wires, instant, and ACH—into one place. The goal is to let payments move through the best rail automatically, based on what works for the customer and the institution: timing, cost, and limits all matter.

Wire transfers are getting a major upgrade in 2025. The July 14 ISO 20022 deadline is pushing financial institutions to move away from old formats and adopt a richer, more structured messaging standard. This shift means wires will carry more detailed information, which helps with compliance, fraud checks, and better customer service. Institutions that modernize their wire systems can save serious time, automation can cut handling time in half, and richer data to catch mistakes before they happen. With ISO 20022, wires also become easier to reconcile, track, and I have seen how FIs can save 30-50% on current wire costs with Alacriti’s modern wire solutions. Which is a big win for both operations and customers.

Instant payments are now a must-have.

They’re what both businesses and consumers now expect from their financial institutions. If those expectations aren’t met, people are ready to move their money

According to Datos Insights, 87% of U.S. midsize and large businesses say instant payments are important or very important to their operations. Nearly two-thirds (66%) of those businesses are likely to use instant payments if their financial institution offers them. On the consumer side, 77% prefer instant digital payments when given the choice, and 29% are willing to pay a fee to receive funds instantly.

According to Datos Insights, 87% of U.S. midsize and large businesses say instant payments are important or very important to their operations. Nearly two-thirds (66%) of those businesses are likely to use instant payments if their financial institution offers them. On the consumer side, 77% prefer instant digital payments when given the choice, and 29% are willing to pay a fee to receive funds instantly.

The stakes are high. Research shows that customers are ready to switch financial institutions to get access to instant payments. Financial institutions that have implemented them report a 93% increase in customer retention.

For businesses, the need is even more urgent. Payroll processors, gig platforms, and employers want to pay workers on demand. Title and escrow companies need instant payments to close real estate deals faster. Fiduciary services managing bankruptcy cases rely on timely disbursements to meet court deadlines. The list goes on: insurance, marketplaces, and e-commerce platforms are all prioritizing instant settlement.

When instant payments are available, institutions benefit behind the scenes too. Reconciliation gets easier, errors are reduced, and detailed transaction data supports better compliance. All of that adds up to less manual work, fewer delays, and more reliable service for everyone involved.

Banks and credit unions are also looking for unified payment solutions. These platforms let them manage wires, instant payments, and ACH from one place using a single API. With everything connected, they can route payments through the best rail automatically, based on timing, cost, and limits. That also means better visibility across rails for tracking performance, managing liquidity, and improving cash flow. Built-in fraud controls and compliance tools keep everything secure and current with evolving standards.

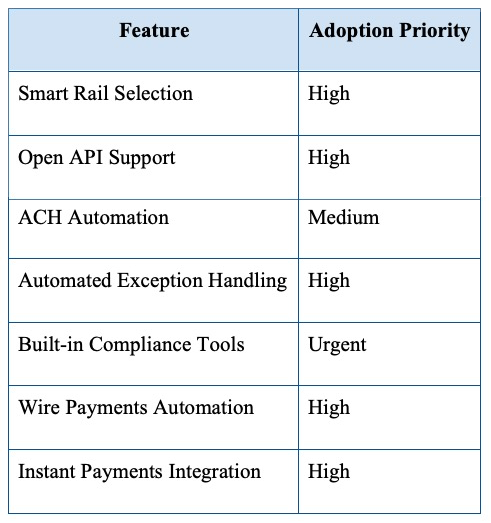

Here’s what financial institutions say they are expecting from payment solutions in 2025:

Banks and credit unions want solutions that handle wires, instant payments, and ACH with less manual work, smarter routing, and stronger security; all in one system. The right payment solution gives them the flexibility to add new features as needed and helps them stay ahead of customer expectations.

What the Feedback Says

Institutions using Orbipay consistently highlight its seamless integration and operational efficiency. The platform’s open API architecture allows for effortless integration with existing systems, eliminating the need for extensive overhauls. Users appreciate the intuitive interface, which provides clear visibility into transaction processes, enhancing transparency and trust. Built-in features such as real-time fraud detection and OFAC screening are seamlessly incorporated, ensuring compliance without adding complexity. This comprehensive approach enables financial institutions to streamline operations, reduce manual workloads, and deliver enhanced services to their customers.

From fraud checks to OFAC screening, it’s all built in.

Nothing feels bolted on.

Getting Started

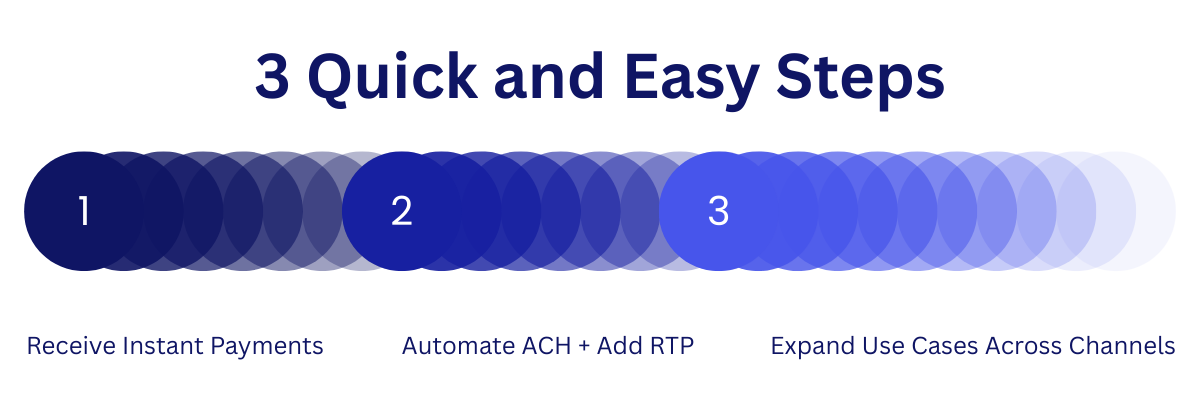

Most institutions start by enabling the ability to receive instant payments. That gets results without disruption. Later, they add outbound payments and advanced capabilities, and more often than not, they then modernize their wire and ACH. Alacriti supports that path with built-in flexibility, fraud tools, and core integration. Institutions keep their existing systems in place, move at their own pace, and gain full control over how and when new features go live. No need to rebuild what already works.

Most institutions start by enabling the ability to receive instant payments. That gets results without disruption. Later, they add outbound payments and advanced capabilities, and more often than not, they then modernize their wire and ACH. Alacriti supports that path with built-in flexibility, fraud tools, and core integration. Institutions keep their existing systems in place, move at their own pace, and gain full control over how and when new features go live. No need to rebuild what already works.

Final Word

Real-time payments aren’t a future concept. They’re already live, scaled, and expected. Alacriti isn’t pitching future plans. They’re showing what works, and who it’s working for.

This article was sponsored by Alacriti. All opinions and insights are authored independently by Tedd Huff.

About the Author: Tedd Huff is the Founder of Voalyre, and Diamond D3, professional services consulting firms focused on global payments and marketing. He is also the founder and executive producer of the Fintech Confidential network featuring entertaining information focused on Fintech industry insights, market trends, news, and life stories from Fintech leaders, thinkers, and doers. Subscribe to Fintech Confidential HERE.

Over the past 24 years, he has contributed to FinTech startups as an Advisory Board Member, Founder, Chief Experience Officer, and Chief Strategy officer, providing strategic and tactical direction for Global companies, focusing on growth while delivering innovation, process improvements and user experience-driven value to simplify the complexity of payments.