Canalys Channel & Partnership Technology Stack 2025

by Jay McBain

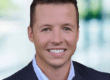

The Canalys Channels Ecosystem Landscape offers an in-depth look at the technologies shaping competitive advantage for channel and partnership leaders.

With 261 companies driving US$7.46 billion in revenue in 2024, this ecosystem is rapidly evolving towards a projected US$13.48 billion by 2028, highlighting the crucial role of automation and data-driven decision-making in partnership success.

For 8 years, this unique “tech stack” research brings focus to the underlying technologies that will drive competitive advantage for channel and partnership leaders in the decade of the ecosystem. The hundreds of software companies represented in the landscape are providing automation and advanced digital capabilities to help companies design, develop, execute and manage a broad channel partner and alliance ecosystem.

There are increasing demands on channel leaders to find, recruit, onboard, develop, incentivize, co-sell, co-market, co-innovate, measure, manage and report on partner value at scale. Automation of partner-related workflows, deeper integrations and data-driven decision-making create measurable competitive advantages (through partnerships) and are quickly becoming table stakes in the industry.

Some interesting facts about the 2025 landscape:

- There were 28 changes from last year’s landscape – these include new companies, M&A, companies shutting down or pivoting away, and re-brandings.

- We are watching additional startup companies in the channel/ecosystem tech space vying for a spot on next year’s landscape. We look for a minimum of three full-time employees and a fully shipping product with delighted/recurring customers.

- From a revenue perspective, 18 of these companies are driving over US$100 million in channel software revenue, and roughly half the list is north of US$10 million.

- There is not the 80/20 revenue split that you find in most lists. The Fortune-sized companies, such as IBM, Oracle, SAP, Salesforce and Adobe, combined drive only 14% of the total revenue.

- There are 40 companies on the landscape founded in the past five years. On the other side of the maturity scale, there are 25 companies over 30 years old. Four of them are over 100 years old! (ACB, Ansira, IBM and Maritz.)

- 166 companies are headquartered in the US. The UK is next with 24 companies, then Canada with 13, then France and Germany with nine each.

- Top headquarters cities are San Francisco with 27 companies, London with 12, New York with eight, and Boston and Seattle with seven each.

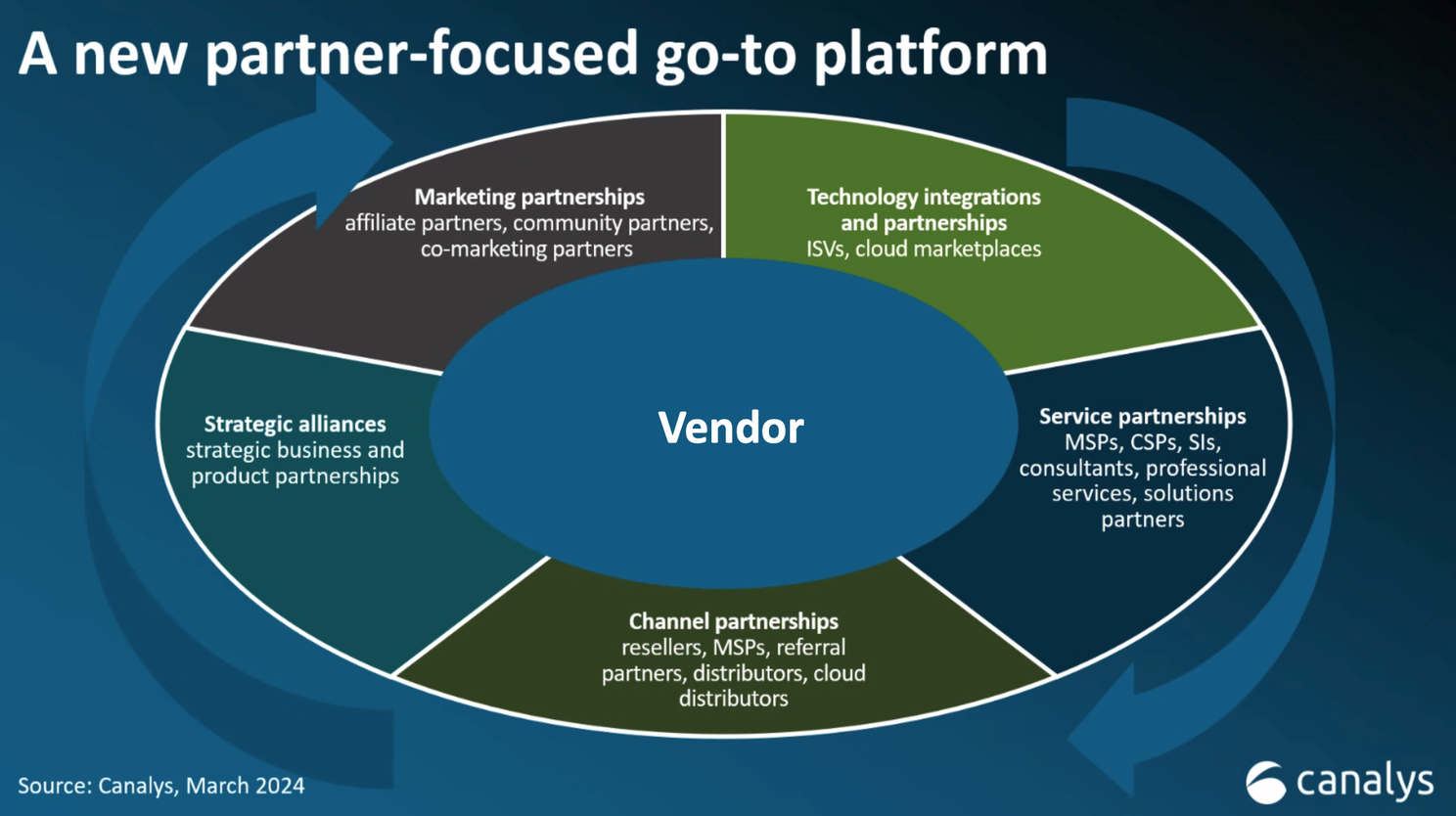

The tech stack recognizes 11 “islands” of innovation. Channel, partnership, alliance, and ecosystem leaders must create their own tech stacks to succeed in modern platforms. This includes measuring and managing the plethora of services, tech integration and alliances, strategic and business alliances, and channels of distribution.

Software that supports resellers isn’t enough anymore. Supporting co-selling, co-marketing, co-innovation, co-development, and co-keeping partners is becoming table stakes in every partner program.

Here are the islands of innovation:

Partner relationship management: Automates various programmatic activities around the management of partner lifecycles. Common features include partner recruitment, onboarding, training, performance-tracking, co-selling, co-marketing, co-innovation, collaboration, enablement and communication. Often seamlessly integrates with existing systems, such as CRM, marketing automation, content management, ERP, payment gateways and collaboration applications.

Through-channel marketing automation: Helps vendors empower their partners to effectively communicate, market and advertise locally while maintaining global brand consistency. Automated platforms provide scale, control and governance that enables partners to generate marketing campaigns using market development funds and proven insights.

Channel incentives management: Helps develop and manage channel incentive programs, spanning allotment, calculation and issuance of performance-based incentives to drive positive behavioral modifications to the partner ecosystem. Common incentives include discounts, rebates, market development funds, co-op funds and sales performance incentive funds.

Channel data management: Manages channel partner data, including data from points of sale, and inventory and incentive data from a single data platform that provides actionable insights and streamlines decision-making processes. These automated tools use AI, machine learning and predictive modeling.

Channel finance, pricing and inventory: Governs indirect sales financials, streamlines reporting processes, calculates true transactional values and avoids allocation errors. Optimizes processes involving pricing, demand forecasting, gross-to-net accounting calculations, inventory planning and price adjustments.

Channel learning and readiness: Helps partner organizations to train and develop employees through the design and delivery of up-to-date training initiatives and resources, spanning training modules, competencies, certifications, learning management systems, online portals, education tracking and sales enablement tools.

Channel ecosystem management: This group supports a broad array of partner types, covering influence, transaction, transaction-assist, retention, and technology, strategic and business alliances. Supports the entire customer buying journey and augments marketing, sales, customer success, product and strategy within an organization. Helps facilitate multi-directional relationships and activities with partners across the entire channel ecosystem. Commonly aids in recruitment, visualization, influence, partner attribution, data, account mapping, marketplace, technology integrations, delivering management, measurement, real-time monitoring and orchestration to drive effective go-to-market strategies.

There are five islands within this:

- Ecosystem recruitment and visualization: Assists in planning, identifying, targeting and recruiting non-traditional partners to drive the expansion of the channel ecosystem and the total addressable market. Provides actionable go-to-market and route-to-market expansion beyond current buyer, industry, geography, segment, delivery or product boundaries.

- Ecosystem influence and attribution: Supports marketing attribution in the post-cookie marketing environment, delivering recognition and incentivization of affiliates, advocates, ambassadors and influencer partners. Helps vendors’ data-driven platforms quantify partner influence and activities and their effect on marketing, sales and retention.

- Ecosystem data and mapping: Enables data-sharing opportunities with and between partners in a controlled and secure manner. Automates account mapping to leverage network effects and streamlines collaboration, co-marketing, co-selling, value creation and co-innovation.

- Ecosystem marketplace and integrations: Helps B2B-centric organizations with the planning, design and execution of internal and external digital marketplaces to expand market opportunities. Supports changing business models toward subscription and consumption models and provides frictionless execution of customer procurement and provisioning of solutions. Assists in marketplace deployment, storefront customization, API integration and listing support, among other aspects, to streamline the workflows of all stakeholders.

- Ecosystem management and orchestration: Automates and simplifies various activities of multi-directional partnerships across the broader channel ecosystem. Supports ecosystem planning, programs, processes and people, including partner onboarding, training and development, co-selling, enablement, collaboration, performance reporting and insights. Often seamlessly integrates with other channel and ecosystem tools.

The full list of the 261 companies (plus island images for download) that are part of the 2025 Channels Ecosystem Landscape can be found here:

https://www.canalys.com/insights/channels-ecosystem-landscape-2025/.

Source: https://www.linkedin.com/pulse/canalys-channel-partnership-technology-stack-2025-jay-mcbain-w1mre/?trackingId=6zw8M4KCQfOj%2FuQvb%2Bt9Hw%3D%3D

Jay McBain is a Chief Analyst at Canalys, leading channels research in North America, as well as being an integral part of the worldwide channels research and advisory team.