Finding the Right ROI in Bank Tech

By: Tyler Brown

Infrastructure Investments

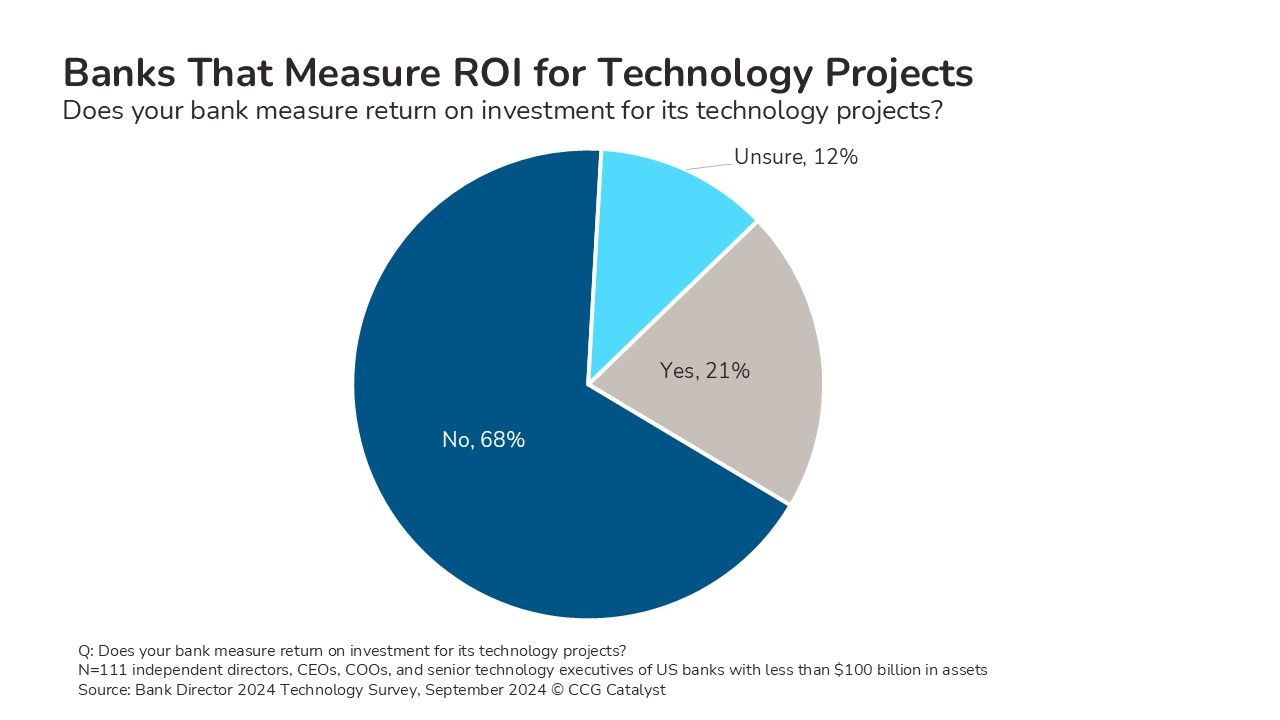

Fewer than a quarter of bankers in a survey by Bank Director said their bank measured return on investment (ROI) for technology projects, implying at least one widespread problem with banks’ technology planning: A resource allocation approach that doesn’t robustly consider the costs and benefits of technology projects on operations and profits. Skipping a careful look at the long-term costs and opportunities may reduce ROI to a fuzzy, emotional judgement that okays or kills initiatives out of feeling rather than metrics.

The failure to measure ROI may also result from insufficient technical knowledge among the board and senior management, too much dependence on vendor pricing and projections, treatment of technology as solely a cost center, or picking other business metrics that are too limited. As bankers think about how to best measure technology ROI, there are a few key pieces to consider:

- Account for the raw costs of maintenance, modernization, and long-run expenses for a given technology choice.

- Link revenue opportunities, cost savings, and strategy to the most relevant business and technology functions.

- Measure the opportunity cost as part of ROI: Even if a system in isolation runs at a loss, is it narrower than in the current state?

- Forecast changes in operational efficiency, revenue, and cost in different scenarios and adjust based on actual numbers. ROI doesn’t just exist at a point in time.

- Think of technology as part of an ecosystem of systems and processes. ROI is a function of how different systems work together and the impact they have on the organization.

Bankers may only implement an ROI framework piece by piece, but it’s a business discipline that takes forethought. The easiest place to start is likely to understand in detail the cost of maintaining existing infrastructure versus modern solutions. It gets more complicated from there. Justifying and managing the cost of a technology project while maintaining existing infrastructure are huge hurdles.

Holistically evaluating the ROI for a new digital banking platform, for example, may require considering the ongoing cost of legacy modules, the professional services expenses for a direct connection to a core banking system and nonnative integrations, new long-run infrastructure costs, and revenue gains from more competitive customer acquisition, account opening, and onboarding (or stemming the loss of prospective customers to more digitally up-to-date competitors).

ROI for technology projects in the end comes down to self-determined, carefully defined business and technology strategies. Senior management needs direction from a technology-savvy, forward-thinking board on business and modernization plans as well as performance indicators to assess costs and returns over time. Otherwise, technology spend risks turning into an avenue for shiny object syndrome.

For more expertise and vision for strategic banking solutions, get in touch with CCG Catalyst https://www.ccgcatalyst.com.