5 Advantages and 2 Challenges of Using Blockchain for B2B Payments

By Ganeshram Ramamurthy

The global B2B payments market has grown considerably through the last decade, and it will continue to do so. A report by Goldman Sachs found that B2B payments are expected to reach $200 trillion by 2028.

That’s over five times the transaction volume between businesses and consumers.

In this regard, the B2B payments market towers over its B2C counterpart like a giant. Yet, with its manual, paper-based methods and outdated payment systems, the B2B market often resembles a slow, mythological giant compared to the rapidly innovating retail payment sector.

Granted, B2B payments are far more complicated than retail, requiring longer decision-making periods and more complicated payment terms. This complexity contributes to the challenges in updating and streamlining these payment mechanisms. Nevertheless, people now expect more convenience and ease during the payment process.

And the same people who seek simplicity in retail transactions are also the ones making B2B payment decisions.

Businesses are catching on, and those in the payments industry are lending a hand by creating solutions backed by blockchain technology. Mastercard, for example, created a solution involving blockchain that improves supply chain traceability and streamlines B2B payments.

In this blog post, you’ll learn about the key advantages and potential challenges of integrating blockchain in B2B payments. We will also explore what blockchain-based payment systems can entail beyond just cryptocurrency transactions, highlighting the importance of modernizing these systems with blockchain technology.

Advantages of Blockchain in B2B Payments

1. Lower Transaction Fees

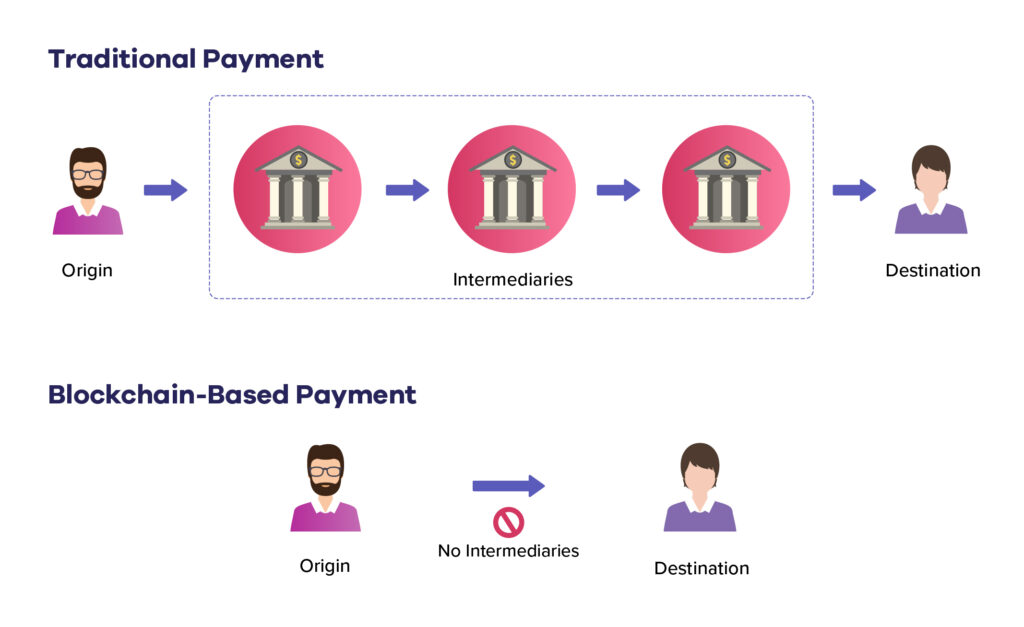

One of the biggest features of blockchain technology is decentralization. No centralized entity is needed to act as a trusted third-party for transactions, meaning no third-party processing or maintenance fees. There are still transaction fees for crypto payments, but they are lower than those of wire transfers and credit card transactions.

By bypassing traditional banking channels and third-party processors, businesses can significantly reduce transaction costs, making services more competitive and increasing profit margins.

2. Faster Settlements

The removal of third parties also makes for faster settlements. Blockchain transactions need to be confirmed only by the blockchain itself, so transactions can be confirmed in an hour or less. This is especially significant for cross-border transfers, as those can take up to five days using traditional means. This speed is crucial for maintaining cash flow and operational efficiency, particularly when dealing with time-sensitive contracts.

Paysail, an enterprise payments startup, is leveraging stablecoins to streamline cross-border B2B payments. This reduces transaction times to below five seconds, the company says, and lowers fees compared to traditional banking methods.

3. Automated Transactions

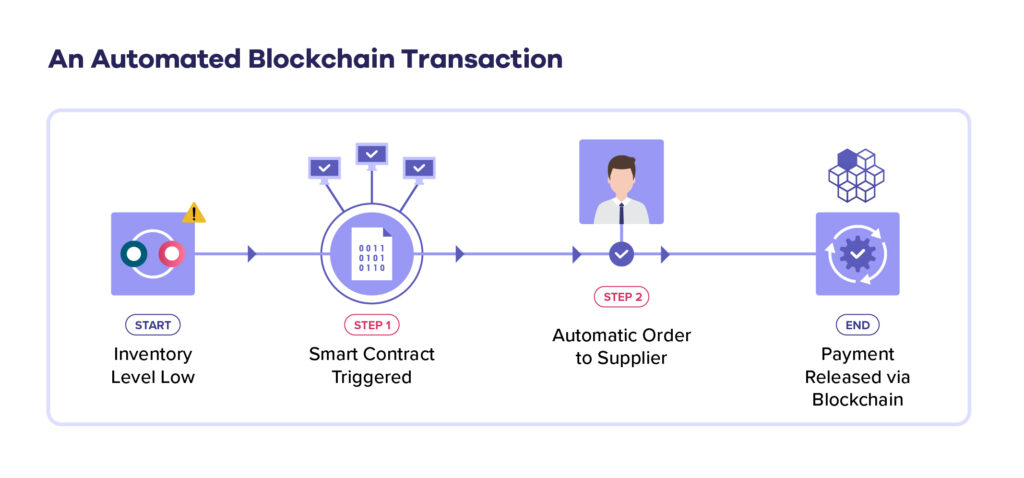

Smart contracts, a feature unique to blockchain technology, enable the automatic execution of transactions once certain criteria are met. This means payments can be processed faster by eliminating the need for manual billing and payment steps. Additionally, smart contracts can be linked with IoT devices to further streamline operations.

For instance, consider a sensor in an automotive assembly plant that monitors the inventory of aluminum wheels. When it detects that the stock of wheels is running low, it automatically triggers an order for more from a trusted supplier. This order uses pre-negotiated prices and payment terms set within a smart contract. The process requires no manual input, ensuring a smooth and uninterrupted supply. This seamless integration not only saves time but also guarantees that the production of vehicles continues without any delays due to wheel shortages.

4. Improved Security

Transactions on a blockchain are immutable, meaning that, once confirmed, they cannot be undone. The blockchain becomes the single source of truth for the buyer and the seller, which mitigates fraudulent activities. In addition to this, data stored on a blockchain is incredibly secure. Unlike centralized databases, data on a blockchain is stored across shared ledgers and protected with built-in cryptography, making it much harder for a hacker to access or change the data.

5. Flexible Payment Options

While even checks (which come with their own headaches) are still widely used in B2B transactions, it won’t be long until payment options like crypto, virtual cards, and buy now, pay later become the norm — just as they are gaining rapid adoption in the B2C sector. Blockchain technology can accommodate flexible payment options like these, which can encourage faster payments as well as improve customer satisfaction and loyalty.

Challenges of Cryptocurrency as a Payment Method

Although blockchain for payments doesn’t always require cryptocurrency transactions, accepting cryptocurrencies in both B2B and retail contexts does bring notable benefits as well as challenges.

1. Time for Transaction Finality

Transaction finality describes the state of a transaction on a blockchain when it is considered complete and irreversible.

For example, a typical Bitcoin transaction takes about 60 minutes to reach this final state. However, there are innovative solutions to speed this up. One such solution is Layer 2 technologies, like the Bitcoin Lightning Network. These technologies work by handling transactions on a separate layer (Layer 2), which sits on top of the original blockchain (Layer 1). This approach speeds up transactions without sacrificing the security and reliability of the main blockchain.

2. Volatility of Value

Cryptocurrency values can be extremely volatile, which is a major reason why cryptocurrencies have not seen more adoption as a form of payment. The worry for businesses is that after accepting a form of cryptocurrency in exchange for a good or service, the value of it could drop sharply. To ease this worry, stablecoins can bridge the gap between fiat and crypto. Stablecoins are cryptocurrency designed to maintain a stable price by being tied to a real-world asset such as the U.S. dollar.

Redefining B2B Payments with Blockchain: Beyond Cryptocurrency

Blockchain technology in B2B payments isn’t limited to transacting in cryptocurrencies like Bitcoin or Ethereum. It’s about leveraging blockchain’s inherent benefits — such as transparency, security, and efficiency — in mainstream finance. A prime example is JPMorgan’s JPM Coin. Unlike typical cryptocurrencies, JPM Coin represents a digital dollar, facilitating real-time, efficient transactions on a blockchain platform.

This innovation allows companies like Siemens and FedEx to automate their payment processes. For instance, Siemens uses JPM Coin for conditional, automatic fund transfers, addressing specific business needs like contingency payments. Similarly, FedEx plans to utilize this system for streamlined, rule-based payments.

Using this method, recipients receive actual currency, not tokens.

This marks a significant shift in B2B transactions, blending traditional financial reliability with blockchain innovation, pointing to a future where blockchain enhances, rather than replaces, conventional payment methods.

Conclusion

Widespread modernization of B2B payment systems through adoption of blockchain technology will take some time, but it’s essential in order to gain the benefits of lower transaction fees, faster settlements, automated transactions, improved security, flexible payment options, and more.

Moving away from traditional processes and legacy systems is needed for this, but it takes intricate knowledge of digital infrastructures in addition to payment processing. Working with a knowledgeable partner is often a smart move for modernization efforts.

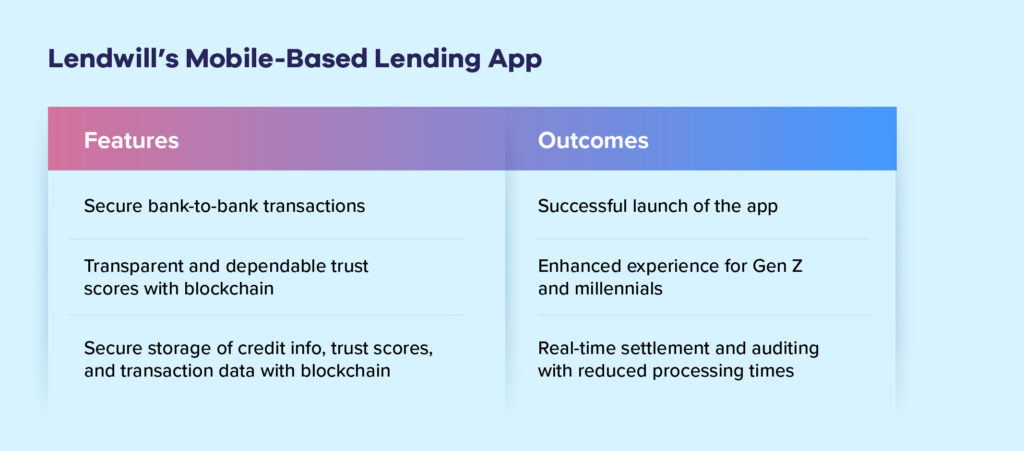

We’ve Been That Partner

We collaborated with a fintech startup on their project to launch a mobile-based peer-to-peer lending app. Our role involved creating a blockchain solution capable of handling direct bank-to-bank transactions and securing sensitive data. This solution allowed the app to integrate seamlessly with banks using Open Banking APIs and PSD2, as well as securely store credit information, trust scores, and transaction data.

The use of smart contracts on the blockchain enabled the client to automate lending and borrowing processes, leading to faster settlements and streamlined auditing.

What Relevantz Can Do for You

At Relevantz, we provide custom blockchain engineering services tailored to your business needs. In an era where blockchain is revolutionizing payments and digital asset tokenization is on the rise, we’re here to help you navigate these changes.

View our infographic on the rise of digital asset tokenization to understand this trend better.

Ganeshram Ramamurthy is a Technical Architect, Blockchain Enthusiast, and Smart Contract Developer at Relevantz.

I was lured into a crypto currency investment platform that I came across on Instagram. I lost about $508,000 to this evil scheme after I invested and accumulated profits, I was denied withdrawals on the specified date. I wrote to the customer support but I was given no feedback, I knew I had been scammed and I started to search for a way to recover my crypto. I considered myself fortunate that I stumbled upon a post on the internet web about a recovery expert, Recovery Hacker101. I would highly recommend Recovery Hacker101 to anyone who wants to recover their lost funds from any scam. she is best in the business and will do anything possible to help you get your money back. I never thought it would be possible to get back crypto once it is sent but I’m super happy and grateful for the services of Recovery Hacker101. Kindly reach out to her if you need any help or any assistance in recovering your money from these scammers. If you lost access to your crypto wallet or lost your crypto password, or your phone was compromised I would highly recommend Recovery Hacker101 to anyone who wants to recover their lost wallet or you lost your crypto password or from any scam. She is the best in the business and will do anything possible to help you get your information and money back. I never thought it would be possible to get back those information that I lost or my crypto once it was sent but I’m super happy and grateful for the services of Recovery Hacker101. Kindly reach out to the company if you need any help. Contact On Email: recoveryhacker101@gmail.com

GREAT WHIP RECOVERY CYBER SERVICES THE BEST IN ONLINE RECOVERY CALL LINE:+1(406)2729101

I’m Kim Tremblay living in Toronto,Canada. I’ve always been careful with my money until one night I stumbled onto a sleek website offering Guaranteed Bitcoin Doubling.

The site looked professional. The testimonials sounded real. I invested $640,000 in Bitcoin hoping it will double the amount the company told me. Hours passed, the website stopped responding, customer support vanished and right there, I realized I’ve been scammed. I couldn’t sleep that night.

In the morning, I searched frantically online on how to recover scammed Bitcoin, then I came across GREAT WHIP RECOVERY CYBER SERVICES and saw testimonials of how it has helped people recover bitcoins by online fraudsters. I contacted the agency and gave them all the necessary information about my transaction, after 72 hours they called me to inform me that my money had been recovered.

If you have ever fallen victim to online fraudsters, you can contact GREAT WHIP RECOVERY CYBER SERVICES on this number.

Call or Text:+1(406)2729101

Email: greatwhiprecoverycyberservices @ gmail . com

Hello everyone. I’d like to share my personal experience from one of the most challenging times in my life. I’m based in Sydney, Australia, and on November 13, 2025, I fell victim to a fraudulent cryptocurrency investment platform that promised substantial financial growth. Believing their claims, I invested a total of $220,000 with the expectation of earning solid returns. However, when I attempted to withdraw my funds, all communication abruptly stopped. My calls were ignored, my emails went unanswered, and I was left feeling completely powerless. Like many others, I had heard that Bitcoin transactions are impossible to trace, so I assumed my money was lost forever. After some time, I discovered information about GREAT WHIP RECOVERY CYBER SERVICES, a reputable digital asset recovery firm. I decided to reach out to them, and to my astonishment, they were able to help me recover the full amount I had lost. I’m sharing my story in the hope that it may help someone else who is going through a similar situation and looking for support. Their contact is,

Email: greatwhiprecoverycyberservices @ proton . me

Call: +1(406)2729101

Hello everyone. I’d like to share my personal experience from one of the most challenging times in my life. I’m based in Sydney, Australia, and on November 13, 2025, I fell victim to a fraudulent cryptocurrency investment platform that promised substantial financial growth. Believing their claims, I invested a total of $220,000 with the expectation of earning solid returns. However, when I attempted to withdraw my funds, all communication abruptly stopped. My calls were ignored, my emails went unanswered, and I was left feeling completely powerless. Like many others, I had heard that Bitcoin transactions are impossible to trace, so I assumed my money was lost forever. After some time, I discovered information about GREAT WHIP RECOVERY CYBER SERVICES, a reputable digital asset recovery firm. I decided to reach out to them, and to my astonishment, they were able to help me recover the full amount I had lost. I’m sharing my story in the hope that it may help someone else who is going through a similar situation and looking for support. Their contact is,

Website: https://greatwhiprecoveryc.wixsite.com/greatwhip-site

Email:greatwhiprecoverycyberservices@proton.me

When my online platform account was suddenly frozen and I lost access to $120,500, I wasn’t sure how to move forward. I came across LUCY ADAM and decided to reach out. From the outset, they were honest and transparent, clearly outlining the recovery process without making unrealistic assurances. They provided regular updates throughout, and I’m happy to say that every dollar was successfully recovered. Their professionalism and clear communication made a very stressful experience far easier to handle, and I’m sincerely thankful for their support.

Contact her via: Lucyadamrecoveryfirm@gmail.com

WhatsApp: +1 (757) 304-6355

What began as a promising investment soon turned into a nightmare, resulting in a devastating loss of $157,560. The realization that I had fallen victim to a scam left me feeling ashamed, angry, and unsure of what to do next. During my search for a solution, I came across EMILYSURVEY.ORG. Though initially skeptical, I was quickly impressed by their professionalism. Their team treated me with respect, explained the recovery process clearly, and avoided unrealistic promises. They maintained steady communication throughout, which was incredibly reassuring. To my surprise and relief, they managed to recover a significant portion of my lost funds.

You can reach out via:

Email: emilyhenry159(@)gmail.com

WhatsApp: +1 (925)-52-49-842

The popularity of bitcoin and cryptocurrency, in general, is at an all-time high. This has also however led to a large increase in the number of cryptocurrency investment scams and cryptocurrency scams in general. Other related forms of scams that have also skyrocketed include binary options scams, Forex scams, investment scams, etc.

There are a lot of fraudulent cryptocurrency investment websites, as well as fake binary options and Forex brokers. A lot of investors have lost (are still losing) money to these bitcoin cryptocurrencies and binary options Forex investment scams. So what do you do when you want to recover scammed bitcoin, cryptocurrency, as well as funds lost to binary options Forex or investment scams?

You are guaranteed to get your stolen funds back by following the three steps listed below;

**File a Report with shieldstridehub . com

A few months back, my credit score was tanking fast until TheCybergoatTechie stepped in. Initially skeptical, I took a chance after my cousin swore by their work. They dug through my credit report like detectives, pinpointting every error and walking me through each dispute with precision. No fluff, just action. Before long, late payments and false marks vanished, and my score clawed its way up 127 points. Transparent updates and solid results. If your credit’s dragging you down, shoot them an email at thecybergoat@techie.com or hit up their WhatsApp at (334)359-8071. Game-changer.